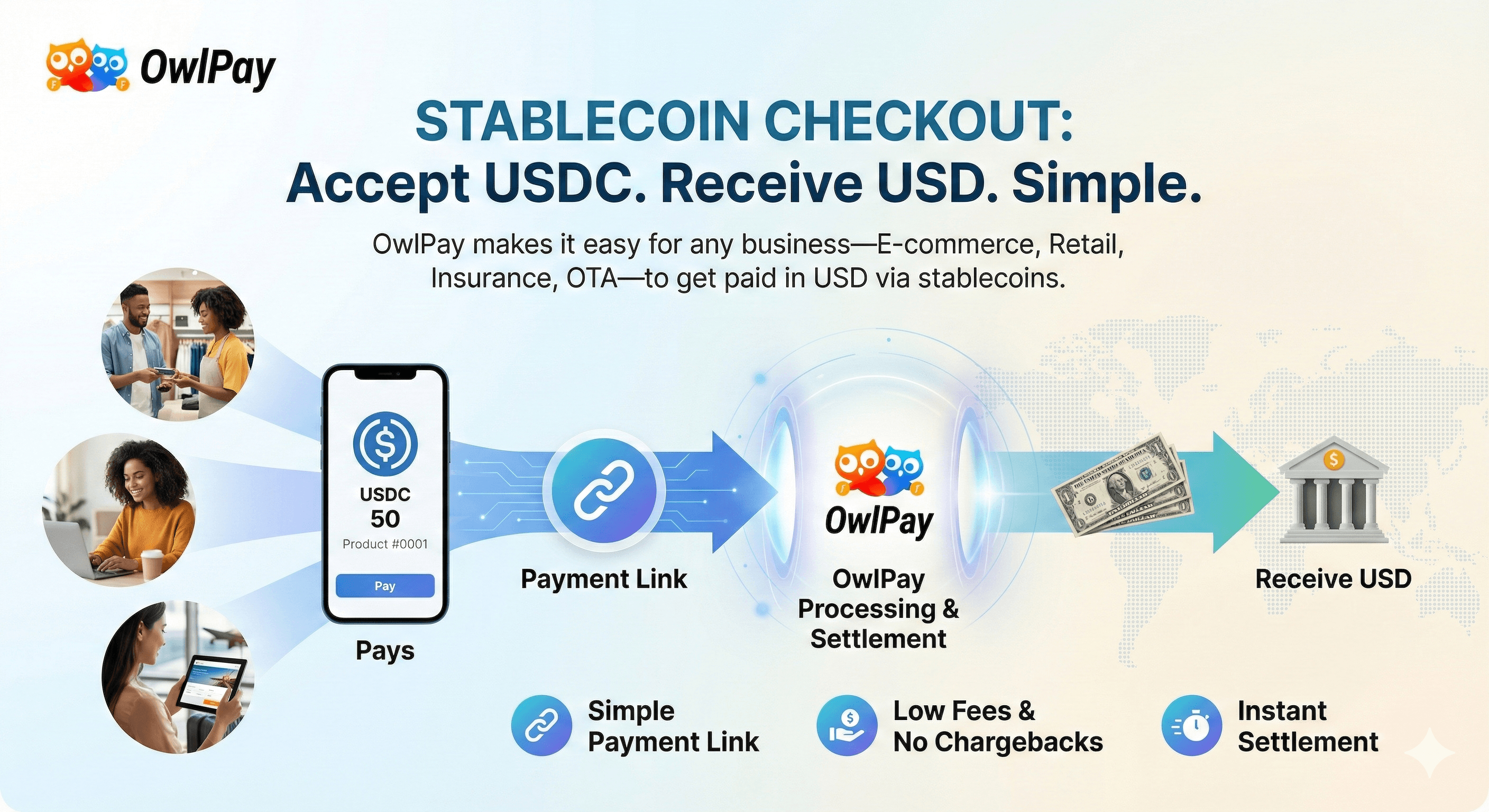

Stablecoin Checkout: Accept USDC and Receive USD Through a Simple Payment Link

Stablecoin payments are getting more attention, but for most businesses the question is not whether stablecoins should become the primary payment method. The real question is simpler.

When a customer wants to pay in USDC, can you complete the sale quickly with minimal effort.

(Images shown are AI-generated. They are for informational and illustrative use only.)

(Images shown are AI-generated. They are for informational and illustrative use only.)

Why many businesses hesitate on stablecoin payments

A common concern is straightforward.

“If usage is low, is it really worth the time and effort to add another payment option?”

If accepting stablecoins means engineering work, checkout changes, and ongoing operational overhead, it can be hard to justify the effort for something that may only be used occasionally.

A more practical mindset: be ready before volume is big enough

Here is the shift. Stablecoin payments do not have to be your primary payment method.

You do not need to wait until the volume is big enough to start. What matters is being ready so you do not lose a customer when the moment comes.

Early demand often looks small, but the opportunity cost can be real when the customer who asks is the one you do not want to lose.

The real moments where this matters

In practice, stablecoin payments are often most valuable when a standard card flow is not ideal.

- A cross border customer cannot complete a card payment.

- A higher value order makes chargebacks feel too risky.

- You want faster confirmation for a time sensitive purchase.

- Or you simply want to offer one more option to customers who already prefer paying in USDC.

These cases may not happen every day. But when they do, they can decide whether the transaction completes or disappears.

The real blocker is usually the implementation burden

Most businesses do not say no because they dislike stablecoins. They say no because the default assumption is that stablecoins require a major checkout rebuild and ongoing operational overhead.

Even teams that are curious often pause because they do not want to commit resources for an uncertain level of demand.

OwlPay Stablecoin Checkout: built as a low effort option you can keep ready

OwlPay Stablecoin Checkout is designed to remove that burden.

- You do not need to rebuild the checkout.

- You do not need to change your payment stack.

You enter the amount and order details, generate a payment link, and share it with the customer. The customer pays in USDC. You receive USD.

This makes stablecoin payments feel less like a long project and more like a ready option you can use when it matters.

You can start with payment links first. When you are ready to scale, you can integrate via API so USDC payments and USD payouts run inside your own platform, using the flow your team already prefers.

(Images shown are AI-generated. They are for informational and illustrative use only.)

(Images shown are AI-generated. They are for informational and illustrative use only.)

It is not only about reach: it can also reduce costs and risk

Keeping a stablecoin option ready can be practical even when usage starts small.

Card fees are often around 3 percent. In many setups, stablecoin payment flows can be meaningfully lower. On top of that, the USDC payment flow can avoid chargebacks. That matters for higher value orders and cross border transactions.

You are not adopting stablecoins because you expect everyone to use them tomorrow.

You are keeping an option available that can be cheaper and lower risk when the right customer asks.

How to test it with minimal effort

You do not have to roll this out to everyone on day one. A lightweight test works better.

Imagine you run an online shoe store. Most orders go through cards as usual, but once in a while a cross border customer cannot complete a card payment, or a higher value order makes chargebacks feel like a real risk.

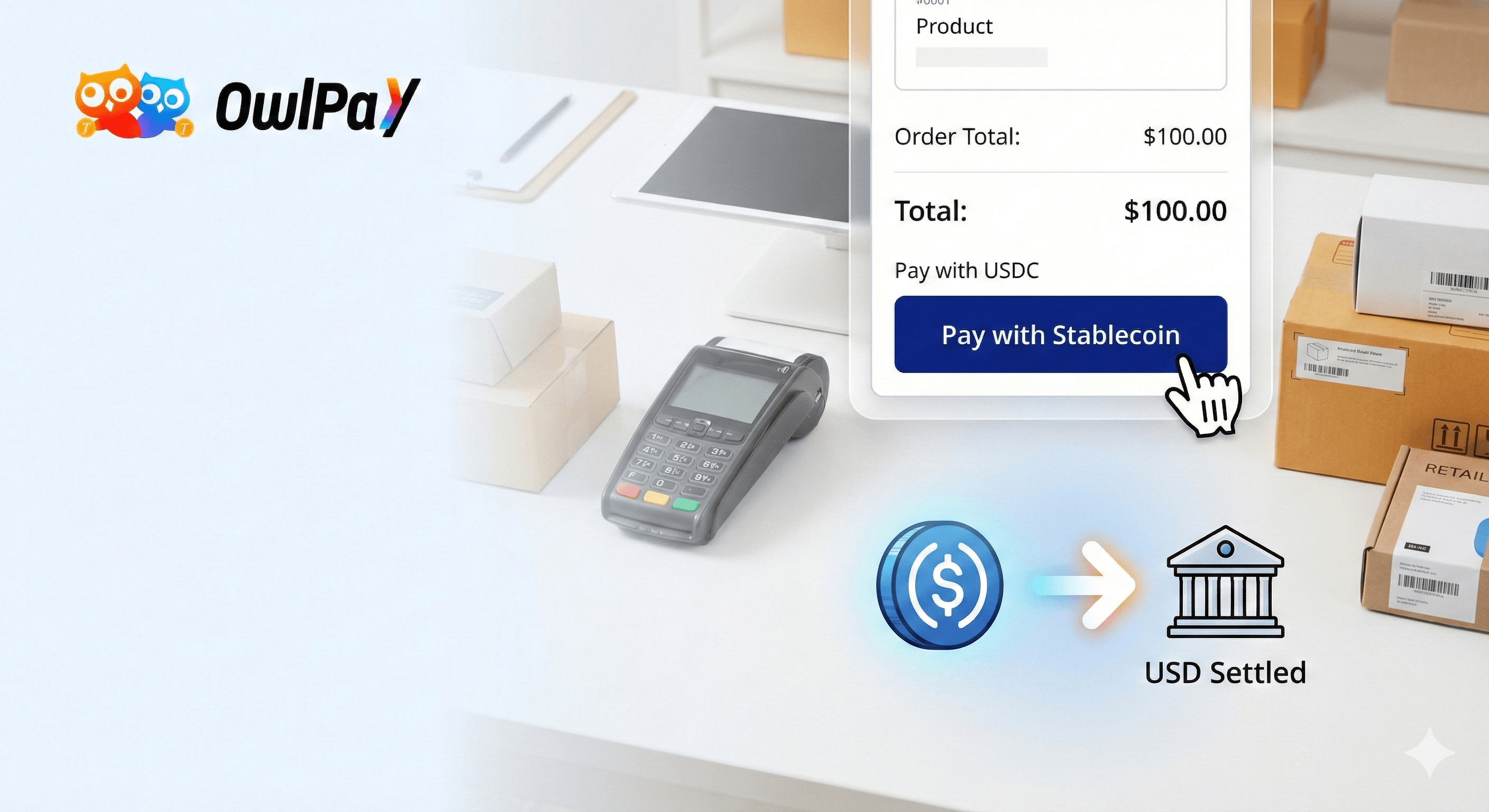

At that moment, you do not need a checkout rebuild. You simply create a USDC payment link in the OwlPay dashboard by entering the order amount and details, then share the link with the customer by email or chat. The customer pays in USDC, and you receive USD.

Now imagine a retail store with a POS counter. A customer wants to pay with USDC, but your card terminal does not support it. You can still complete the sale by generating a payment link for the exact amount and sending the payment link to your customer.

The customer pays in USDC on their phone, and you receive USD. Your team can confirm payment status in the dashboard before handing over the item.

These are just two examples of how businesses use it in the real world.

The idea is to keep USDC as a ready option you can pull out when a situation calls for it, without committing to a full rollout. Over time, you will see when customers ask for it, which scenarios it helps most, and whether it saves deals you might otherwise lose.

When a customer asks, you can say yes

The goal is not to collect the most USDC payments today. The goal is to be ready.

If a customer asks, “Can I pay with USDC?” you can confidently say, “Yes.”

Want to keep a USDC payment option ready in minutes. Request a demo of OwlPay Stablecoin Checkout.