Stablecoin Checkout + x402: A Practical Path to Chargeback-Free Payments for Businesses

Chargebacks were designed to protect cardholders. But for merchants and platforms, they’ve become a recurring tax on growth and creating real cost. Dispute fees, lost revenue, operational workload, and uncertainty all compound over time.

This is where stablecoin checkout, combined with x402 AI agent-initiated payment flows, offers a fundamentally different approach: final settlement by design with smarter pre-check.

Why chargebacks happen

For businesses that accept cards, chargebacks usually fall into a few patterns:

- Fraud using stolen credentials

- Product not received or delivery disputes

- Unrecognized transactions (often descriptor confusion)

- Customer dissatisfaction or “friendly fraud” (disputing a legitimate purchase)

The merchants are usually powerless, since card network rules often allow a cardholder to file a dispute, and the merchant must respond, prove, and absorb overhead.

How big is the problem and what does it cost?

Chargeback fraud is widespread, Worldpay notes that 34% of merchants globally experience chargeback fraud. worldpay.com As commerce grows globally, friendly fraud and dispute volume push both chargeback counts and the cost per dispute higher over time.

Mastercard’s 2025 analysis also references an estimate of 261 million chargebacks generated annually in 2025. Mastercard B2B Not just the disputed order value, it also includes internal labor, processor fees, and the ongoing cost of operating a dispute pipeline.

The risk also varies by industry. For example, one industry breakdown shows higher chargeback rates in categories like Education and Training (about 1.02%) and Travel (about 0.89%), compared to lower-risk verticals. clearlypayments.com

Why stablecoin checkout changes the rules

Stablecoin checkout moves payment settlement onto blockchain rails, where payments function is final settlement. Refunds become a merchant policy decision, not a bank-driven clawback.

With stablecoin checkout (for example, USDC):

- A payment is a transfer of value on chain

- Once confirmed, it is not “pulled back” through issuer dispute rules the way a card payment can be

This changes the economics of payment risk:

- No forced reversals through card dispute rails

- No dispute processing fees imposed by card networks

- Less operational overhead spent fighting disputes

Important note for clarity: this does not mean refunds disappear. It means refunds become intentional and programmatic, rather than triggered through third-party dispute systems.

Where x402 fits: Increase certainty before payment

Final settlement is powerful, but it raises an obvious question: If payments settle finally, how do you prevent bad payments before they happen?

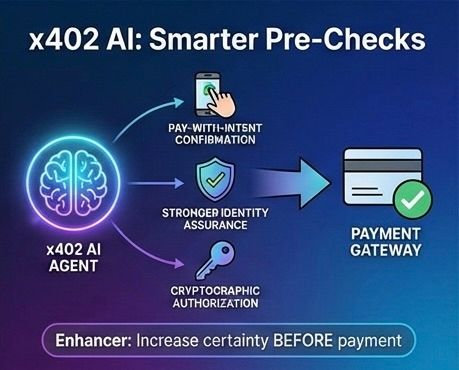

This is where x402, AI agent-initiated payments, can switch the problem from: “Fight disputes after payment” to “Increase certainty before payment”

Examples of pre-transaction guardrails you can add

Depending on your product and risk profile, an x402-enabled stablecoin checkout flow can support steps like:

- Pay-with-intent confirmation

Require explicit confirmation for the exact amount, merchant identity, and item context to reduce accidental payments and “I bought the wrong one” disputes. - Stronger identity and account assurance

For high-risk flows, request additional verification or step-up checks before allowing payment. - Cryptographic authorization

Users sign transactions cryptographically, creating strong proof that payment was authorized by the wallet holder.

The result is not “zero fraud forever,” but a meaningful reduction in frauds and disputes which usually cause the chargebacks.

Practical examples by industry

Everyday commerce (retail, daily necessities, food delivery)

A common scenario is delivery conflict:

- When: A package is marked delivered but the customer claims it wasn’t received

- Then: The merchant gets hit with a dispute, fees, and staff workload

With stablecoin checkout:

- Funds settle to the merchant once payment completes

- If a refund is appropriate, the merchant can refund directly without being forced through a card-network dispute process

This is especially valuable for teams that want to keep customer support focused on resolution, not paperwork.

High-value items (luxury, electronics, premium services)

Chargebacks scale painfully with ticket size, the higher the order value, the greater the financial hit and operational stress when disputes occur.

Stablecoin checkout changes the posture:

- Payment is received with final settlement

- Refunds are issued intentionally based on business policy and evidence

- Risk controls can be tightened for high-value purchases using step-up verification and stricter pre-transaction checks

For high end categories, this is more about reducing catastrophic loss events and preserving power for merchants.

Conclusion: Final settlement + Smarter pre-checks.

Stablecoin checkout with x402 offers a different foundation for avoiding chargebacks: Payments settle finally, refunds become merchant-controlled, costs shift away from disputes and toward automatic checkout flow.

If your business is global, digital, or high risk for disputes, this is not just a “crypto payment idea.” It is an operational upgrade.

(Images shown are AI-generated. They are for informational and illustrative use only.)