Why Multi-Layer Approvals Matter for Enterprise Crypto Wallets?

In the fast-evolving world of Web3 and digital assets, enterprises are increasingly exploring crypto wallets not just as storage tools, but as core infrastructure for business operations.

One key feature that distinguishes an enterprise-grade wallet from a personal wallet is the implementation of multi-layer approval workflows. Here’s why this feature is essential and how real businesses are using it today.

What Are Multi-Layer Approvals?

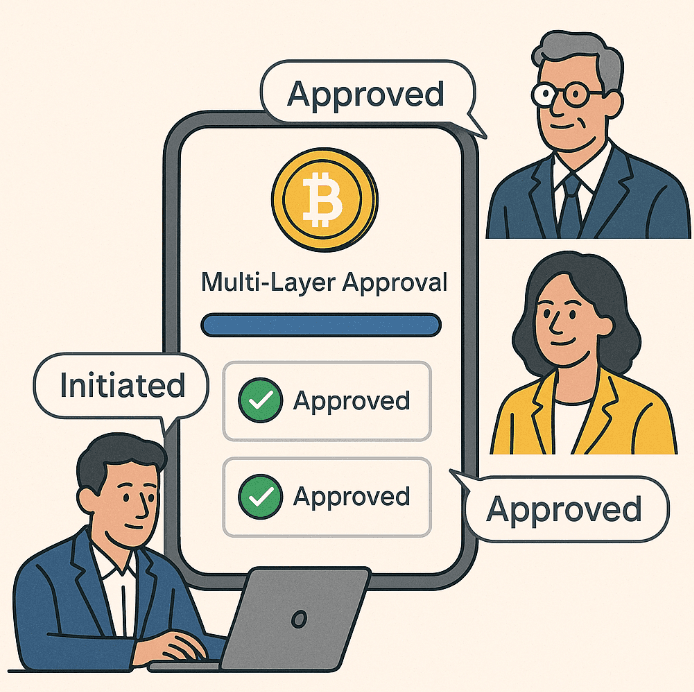

Multi-layer (or multi-level) approvals are workflows that require multiple parties within an organization to review and authorize a transaction before it is executed. This feature adds a layer of internal controls and accountability, helping prevent fraud, mistakes, or unauthorized transfers.

For example:

- A payment initiated by a finance associate may require a manager's approval.

- Large transactions might require both legal and executive-level sign-off.

- Certain wallet actions (like adding a new withdrawal address) may be restricted by multi-user approval.

From Control to Confidence: Why Approvals Are Essential for Enterprise

1. Internal Control and Risk Management

In traditional finance, businesses rely on dual sign-offs and accounting checks. Enterprise crypto wallets must replicate or improve on these controls. Multi-layer approvals ensure no single person has full control of funds, significantly reducing the risk of theft, loss, or mismanagement.

2. Compliance and Auditing

Multi-layer approvals create a verifiable log of who initiated, reviewed, and approved each transaction. This supports compliance with internal policies, regulatory requirements, and audits. Especially in industries handling client funds or high-volume transactions, this is non-negotiable.

3. Operational Accountability

When workflows are structured by department or role (e.g., treasury, finance, legal enterprises) gain clarity on who is responsible for what. This reduces bottlenecks, miscommunication, and potential disputes within finance operations.

What it looks like in Action: approval flows that work

- Cross-Border Payroll

A global tech company uses USDC to pay contractors in Latin America and Southeast Asia. Each payroll batch over $50,000 must be reviewed by a finance lead and approved by the CFO through a multi-layer flow built into their enterprise wallet. This minimizes human error and ensures traceability.

- Token Disbursements

A blockchain project managing a large treasury uses a wallet with tiered permissions. Marketing and partnerships teams can request grants or bounty payments, but these must be approved by a multi-signature council before execution to ensure transparency in token spending.

- Vendor Payments

A Web3 marketplace onboarding dozens of suppliers per month sets up automated vendor payments via stablecoins. However, before any disbursement is made, the system triggers a 2-step approval: one by procurement, another by finance, building directly into the wallet's transaction layer.

What to look for in wallet solutions

If you're evaluating a crypto wallet for enterprise use, look for one that offers:

- Customizable approval policies (based on role, transaction amount, wallet type)

- Real-time notifications for pending and completed approvals

- Audit trails with immutable logs

- MPC or multi-sig security layered on top of the approval process

Conclusion

In the corporate world, crypto transactions are not just about speed. Multi-layer approval workflows bring enterprise-grade control to digital assets, making them safe and scalable for everyday business use.

As Web3 adoption accelerates, businesses that prioritize governance will be the ones best positioned to scale with confidence.

Secure smarter. Approve with confidence. Empower your team with OwlPay Wallet Pro.