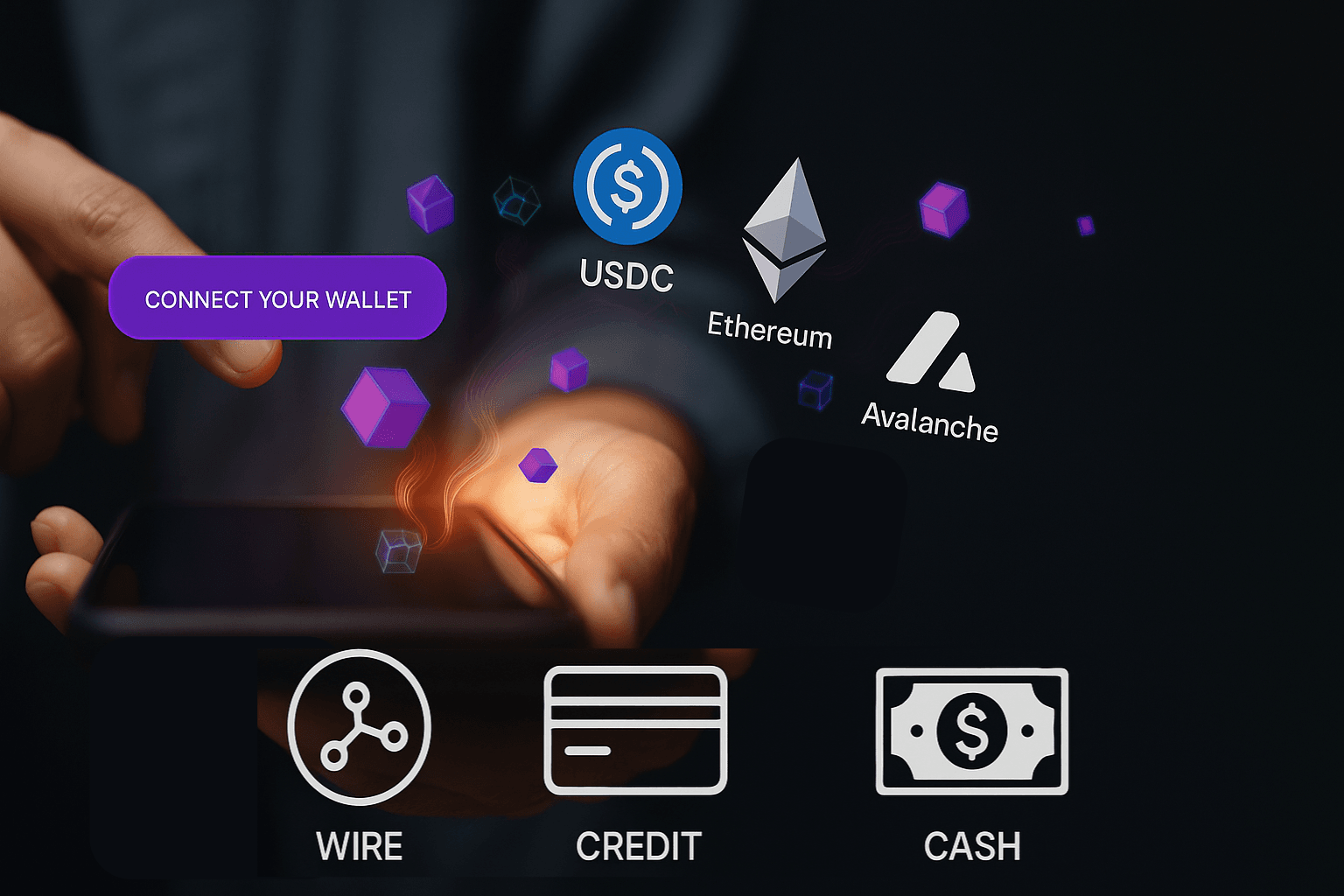

Buying Crypto with a Web3 Wallet: Wire, Credit Card, or Cash?

If you're just getting started with crypto and setting up your Web3 wallet, one of the first things you'll need to decide is: How should I add money to buy crypto?

There are typically three main ways: Wire Transfer, Credit Card, and Cash (via MoneyGram). Each has its use cases, but for most beginners, one option clearly stands out. Here’s a simple breakdown to help you decide.

Wire Transfer – For High-Volume or Corporate Use

Wire transfers are ideal if:

- You're buying a large amount (like over $1,000 USD)

- You're a business or need to invoice and report legally

- Your credit card doesn’t support crypto purchases

Pros:

- Lower fees for large amounts

- Complies with regulatory processes

- Suitable for advanced users or corporate accounts

Cons:

- Slower to process

- Requires a bank account

- Less convenient for everyday users

✅ Best for: Experienced users, companies, or those making large crypto purchases.

Credit Card – The Most Beginner-Friendly Option

Credit cards are by far the easiest and fastest way for crypto newbies to get started.

Why it’s perfect for beginners:

- Fast & Simple: Just enter your card info and you're done—funds usually arrive in your wallet within 5–15 minutes.

- No banking paperwork: You don’t need to deal with banks or wire forms.

- Low barrier to entry: No complicated setup, just a card and your phone.

Even if you don’t have cash on hand or need to act fast during market swings, credit card top-up allows you to instantly join the market without missing opportunities.

Pros:

- Fastest option

- Easy to use — no extra documents needed

- Great for small to medium-sized first purchases

- Ideal for urgent top-ups or spontaneous buys

Cons:

- Slightly higher fees for some platforms compared to wire

- Card limits may apply depending on your provider

✅ Best for: New crypto users, small-to-mid purchases, instant access

Cash (via MoneyGram) – When Banking Isn’t an Option

Cash top-up through services like MoneyGram is useful if:

- You don’t have a bank account or credit card

- You work in informal sectors (e.g., freelancers, gig workers, migrant workers)

- You live in a country with banking restrictions

Pros:

- Doesn’t require a bank account

- Available in countries with limited banking infrastructure

- Offers some privacy

Cons:

- Requires in-person visits to a MoneyGram location

- Not ideal for fast-moving market entries

- Lower daily limits

✅ Best for: Unbanked users or those with limited access to financial tools.

💡What’s the Best Way to Buy Crypto for Beginners?

If you’re just starting out and want a simple, fast, and stress-free way to make your first crypto purchase — credit card top-up is the way to go.

No bank appointments.

No waiting.

Just a few taps, and you’re in.

Whether you're buying a small amount of USDC or jumping in to explore the Web3 world, your first crypto can be just a swipe away.

Ready to try?

🔐 Set up your Web3 wallet and use your credit card to get started in minutes.

Your first crypto transaction is easier than you think.