OwlPay Harbor: Regulated USDC Rails for Global Business Payments

Why USDC adoption stalls in real business operations

USDC is increasingly becoming a practical option for moving value across borders. For global businesses, the promise is straightforward: faster settlement, near 24/7 availability, and a more streamlined path for cross-border flows.

But in real operations, stablecoin adoption rarely stalls because USDC is hard to use. It stalls because turning USDC into a production-ready payments capability requires infrastructure that is difficult to build, and even harder to scale responsibly.

Once you move from a proof of concept to launch, the real requirements show up quickly. Businesses need a compliant way to convert between fiat and USDC, clear controls and responsibility boundaries for how funds move, and payout connectivity that can actually deliver funds to customers, merchants, vendors, or partners—ideally in the currencies they use every day. At the same time, the entire flow must be something finance, compliance, and risk teams can trust, not an experimental setup that creates more operational burden than it removes.

Watch our demo video to see how OwlPay Harbor helps businesses pay with stablecoins.

What OwlPay Harbor is built to do

OwlPay Harbor is built to close this gap.

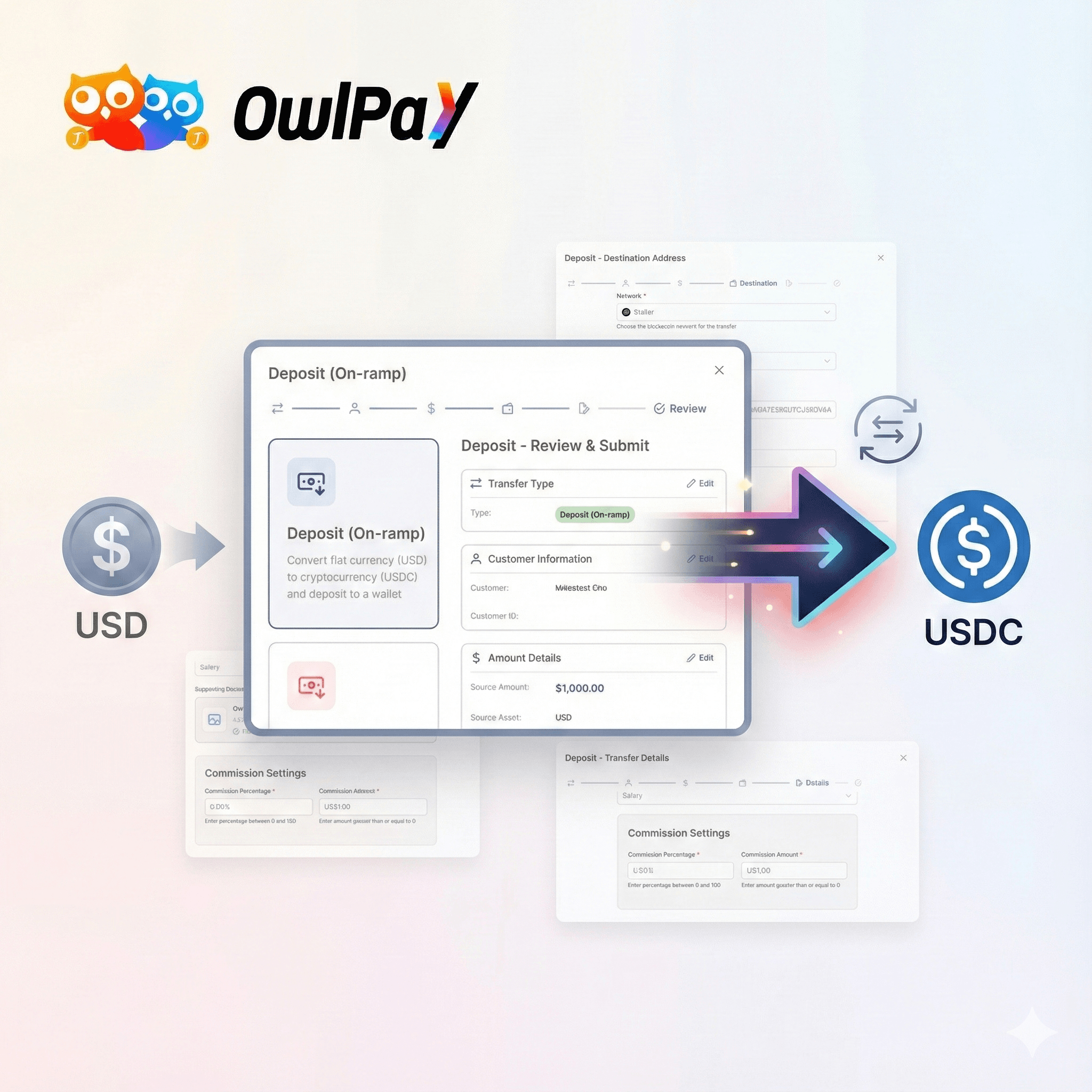

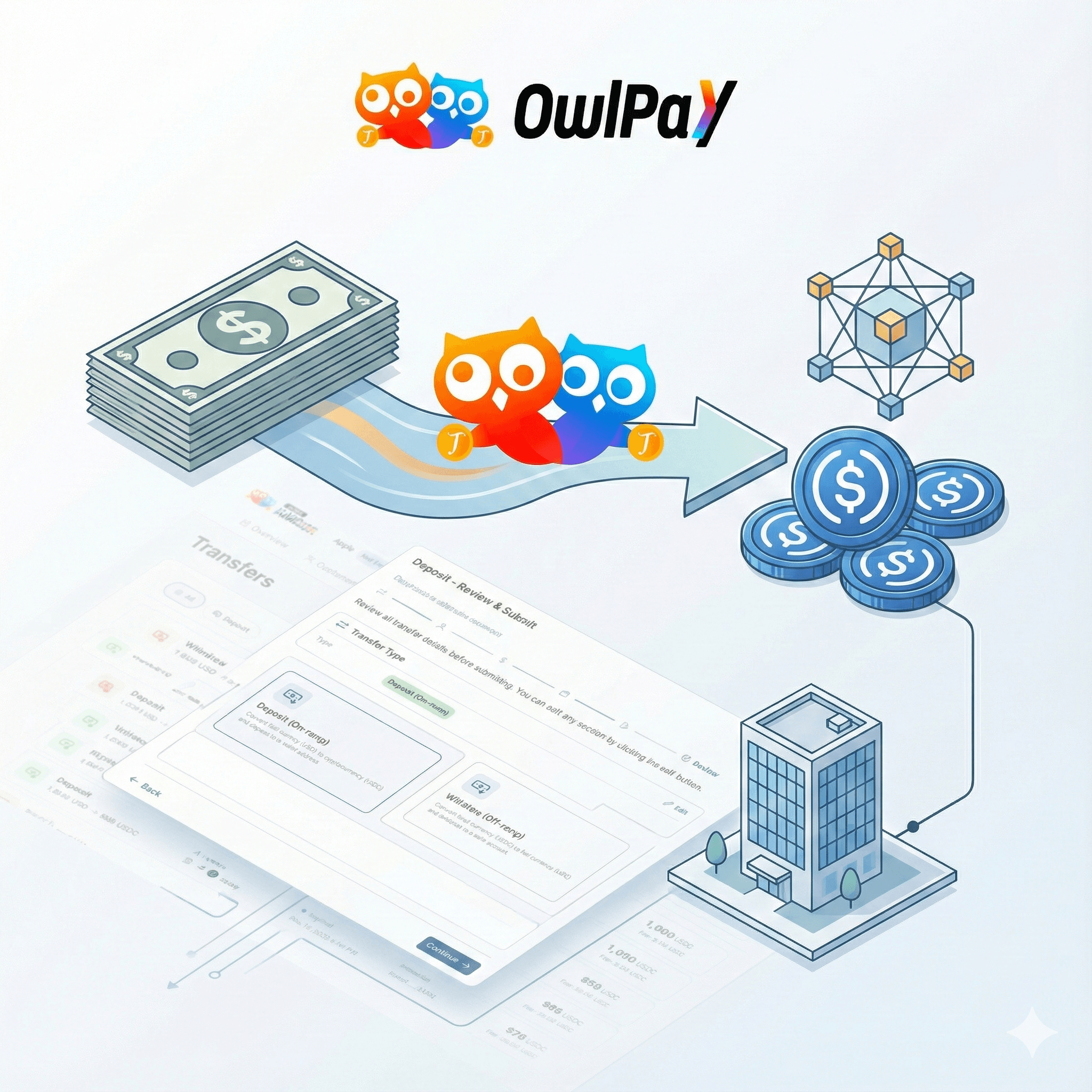

It is an API-based on and off ramp infrastructure that helps businesses convert between USD and USDC and use USDC as a settlement layer for cross-border payments, while still being able to complete the last mile through fiat payouts when needed.

In other words, Harbor is not just about moving stablecoins on-chain. It is designed to help businesses complete real-world settlement and payouts through regulated rails, with a compliance-first foundation.

Besides the API, OwlPay Harbor now also offers a dashboard, so you can operate core flows directly through a simple, intuitive interface.

(Images shown are AI-generated. They are for informational and illustrative use only.)

Two service models that match how platforms actually operate

To make stablecoins work at enterprise scale, infrastructure must match how platforms actually operate. That is why OwlPay Harbor offers two flexible service models, so different types of businesses can adopt USDC in a structure that aligns with their fund flows and operational responsibilities.

Partnership Model

The Partnership Model is designed for platforms such as marketplaces or payment processors that collect funds from users and execute global payouts. In this structure, approved platforms manage the funds and pay OwlPay directly.

This model fits businesses that already run collection and disbursement flows and want to add USDC as a more efficient settlement layer, without rebuilding a full stack of licensing processes, compliance operations, and payout connectivity in-house.

A typical example is an e-commerce platform that collects USD from customers, converts it to USDC via OwlPay, and pays retailers or freelancers across regions. This reduces cross-border friction and improves predictability as volume grows.

End User Model

The End User Model is designed for platforms that prefer not to handle funds directly. In this structure, end users pay OwlPay directly for the USD–USDC conversion, while the platform still delivers an integrated experience through its own UI and product flow.

This approach helps platforms offer stablecoin on and off ramps while keeping the funds-handling boundary clear. In practice, that can reduce operational complexity and make it easier to separate product responsibilities from regulated money movement.

Payout options and supported local currencies

On the payout side, OwlPay Harbor supports USD payouts in supported regions globally. It also supports local payouts in these currencies: EUR (via SEPA), CAD, GBP, JPY, SGD, HKD, ZAR, AED, MXN, NGN, and BRL, with more currencies being added over time.

If the currency you need isn’t listed, please leave your email and we’ll confirm availability and get back to you as soon as possible.

(Images shown are AI-generated. They are for informational and illustrative use only.)

Built for multi-chain stablecoin operations

Harbor is built for multi-chain stablecoin operations, so businesses can work with USDC across major networks while keeping the integration experience consistent.

This matters because many businesses are not committing to a single chain forever. They are building products that need to operate across ecosystems, partners, and regions, while maintaining predictable controls, monitoring, and settlement logic.

The outcome: move value globally with USDC, on regulated rails

At its core, OwlPay Harbor is designed around a simple business outcome: helping companies move value globally with USDC while meeting the real requirements of regulated operations.

That means clear responsibilities for funds flow, pragmatic integration paths, and the ability to complete fiat payouts where customers and vendors actually need to receive money.

If you are building a marketplace, payment platform, remittance or payout workflow, payroll product, or a wallet-enabled experience and you want to use USDC as your settlement layer, OwlPay Harbor is designed to help you launch faster and scale with confidence.

Contact

If you’re exploring USDC-based settlement or global payouts, contact us at owlpaysupport@owlting.com or drop your email, and we’ll get in touch soon.