The End of Chargebacks: Why Merchants Choose Stablecoin Checkout

Chargebacks have been a persistent component of online commerce for many years, and for many merchants they represent one of the most disruptive elements of credit card acceptance. The issue has also shown significant growth. According to Chargebacks911, “E-commerce chargeback rates rose 222 percent between Q1 2023 and Q1 2024” (Chargebacks911, 2025).

Even when merchants fulfill orders correctly and provide accurate delivery proof, the payment can still be reversed weeks later. Although the chargeback system was initially designed to protect consumers, it frequently creates uncertainty for merchants who rely on stable revenue flows and predictable settlement outcomes.

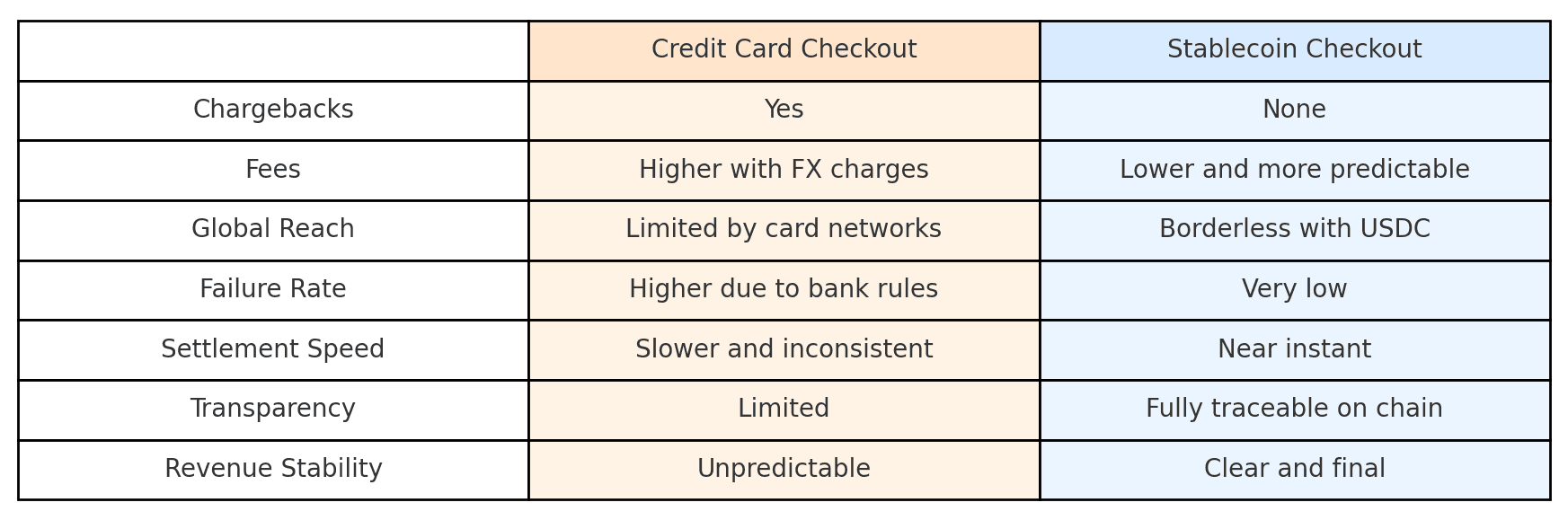

Stablecoin Checkout provides an alternative settlement model. When customers pay with USDC, the transaction is confirmed directly on-chain and becomes irreversible once validated. This characteristic offers a level of transactional finality that traditional credit card systems cannot achieve.

Why Chargebacks Create Challenges for Merchants

Credit cards offer convenience to customers but create operational fragility for merchants. A dispute raised by a customer or an issuing institution may still result in a withdrawal of funds even after the product has been shipped. In such cases, the merchant loses both the product and the revenue. In addition, merchants must manage dispute fees, fraudulent claims, and extensive internal work associated with documentation and reconciliation.

Industry reporting also reflects the increasing operational burden. ChargebackGurus notes that “Over 20 percent of enterprise merchants and 15 percent of mid market firms reported that their chargeback tech costs grew between 10 percent and 24 percent in the past year” (ChargebackGurus, 2025). These increases reflect the rising cost of maintaining systems and workflows needed for chargeback management.

For merchants engaged in cross border commerce, these pressures become even more evident. Payment outcomes may vary based on currency conversion conditions, regional regulatory rules, institutional review practices, and fee structures. These variables can reduce conversion rates and significantly increase operational workload.

How Stablecoin Checkout Addresses Chargeback Risk

Stablecoin Checkout processes transactions directly on-chain using USDC. Once confirmed, a blockchain transaction becomes final, immutable, and permanently recorded. Immutability is a foundational property of blockchain systems and ensures that records cannot be altered retroactively.

The regulatory landscape also provides increasing clarity regarding the role of payment stablecoins. The 2025 GENIUS Act formally states that “The GENIUS Act … establishes a federal framework for payment stablecoins — digital assets pegged to the U S dollar and backed by liquid reserves” (Grant Thornton Insights, 2025; White House, 2025). This reinforces the legitimacy and expected stability of properly reserved payment stablecoins within the United States regulatory environment.

Because each USDC transaction is transparent and tamper resistant, merchants gain a predictable payment experience with no reversals, no dispute fees, and significantly reduced reconciliation overhead.

A More Efficient and Cost Effective Payment Model

Traditional credit card systems involve multiple layers of cost that may include processing fees, currency conversion costs, cross border surcharges, and extended settlement timelines. These layers introduce friction throughout the payment flow, especially for international merchants.

Stablecoin Checkout removes these layers. Payments made with USDC allow merchants to experience the following:

- no foreign exchange fees

- no cross border surcharges

- fewer payment failures

- faster settlement across markets

- clear and predictable revenue outcomes

Customers send USDC from their wallet, and merchants receive USD. OwlPay manages the conversion process and transfers the funds to the merchant’s account without hidden adjustments.

Example of Merchant Benefits

Consider a United States based custom headphone manufacturer serving customers across Europe and Asia. Before implementing Stablecoin Checkout, the business relied heavily on credit card payments for international transactions. These transactions often included cross border fees of approximately three percent. Some payments were unsuccessful due to regional authorization rules, and several chargebacks emerged after shipping.

After adopting Stablecoin Checkout, the merchant experienced improvements including global accessibility for customers paying with USDC, the elimination of foreign exchange fees, the removal of chargeback risk, and faster settlement times. The result was a more stable revenue flow and a more consistent global purchasing experience.

Why Merchants Should Expand Payment Options

Consumers increasingly expect flexibility in the checkout experience. Exclusively accepting credit cards limits access to buyers in regions where card penetration is low or where approval rates are inconsistent. Stablecoin Checkout enables merchants to reduce payment friction, lower costs, and support customers who prefer to use digital assets for payment.

Offering multiple payment options allows merchants to do the following:

- reach customers who do not have credit cards

- support users who prefer digital assets

- reduce payment failures

- avoid foreign exchange fees for international buyers

- reduce exposure to chargeback related losses

- improve conversion through a more flexible checkout system

Stablecoin Checkout does not replace credit card payments. Instead, it strengthens the overall payment stack and increases the stability of revenue collection.

Supporting Global Commerce with Flexible Payment Infrastructure

Credit cards contributed significantly to the growth of early e-commerce but also introduced persistent challenges such as chargebacks, elevated processing costs, delayed settlement, and regional inconsistencies. As commerce becomes increasingly global, these limitations become more visible.

Stablecoin Checkout provides a contemporary alternative. It offers faster settlement, fewer payment failures, simpler reconciliation, transparency on-chain records, and complete removal of chargeback risk. For merchants seeking predictable and globally compatible payment infrastructure, stablecoin based settlement provides substantial operational advantages.

Merchants and platforms considering Stablecoin Checkout are welcome to contact the OwlPay team for assistance with onboarding and integration.

References

- Chargebacks911. (2025). Chargeback Stats: All the Key Dispute Data Points for 2025. Chargebacks911.

- ChargebackGurus. (2025). Chargeback Stats and Insights from Mastercard’s State of Chargebacks Report. ChargebackGurus.

- Grant Thornton Insights. (2025). What the GENIUS Act Means for Stablecoin Issuers and Banks. Grant Thornton.

- White House. (2025). Fact Sheet: President Donald J. Trump Signs GENIUS Act into Law. The White House.